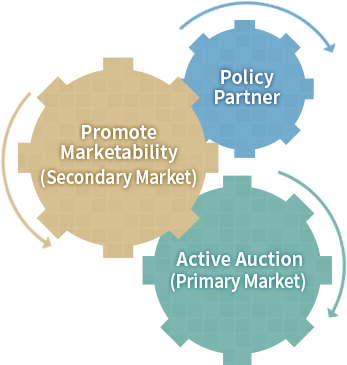

Primary Dealer System

Roles & Obligations of PDs

- step.1 Repoarting & Communication

- Foreigners trading activity

- Market Review

- Policy Proposal

- step.2 Revitalization Participation

- New product

- Enhancement

- step.3 Secondary Market

- Market Making(submitting two-way quote)

- KTB Dealing

- step.4 Primary Market

- Underwriting on-the-run issue

- Retail Sales

The MOEF conducts quarterly PD assessment on their underwriting and market-making performances every six months, and selects top five PDs that will receive the Finance Minister award.

The outperforming PDs are granted rights to non-competitive subscriptions that allow them to additionally underwrite KTBs at the same yield as the highest auctioned yield at the competitive auction. The amount of KTBs they can purchase depends on the results of their semi-annual performance; PDs that placed 1st to 5th can additionally underwrite up to 20% of their total underwriting volume at the competitive auction; those in 6th to 10th up to 15%; those in 11th to 15th up to 10%; the remaining up to 5%. Top five PDs in the monthly assessment are then granted an additional 10%.

In addition, a financial support system is being operated to provide low-interest loans to PDs, using the government’s temporary surplus funds and taking their KTBs as collateral.